If it doesn’t, it is an indication of discrepancies or errors and will require rectification. An organization initially records every financial transaction in a general journal, where the entries are called journal entries. The next step involves classifying journal entries as separate accounts in a general ledger. Owner’s equity is the portion of the business’s assets that you or your shareholders own. When your business records revenue from sales, this will increase owner’s equity because it means that the company has earned more money. On the other hand, if the company incurs expenses, this will decrease the owner’s equity because it means there’s less money available for you to draw out.

Subsidiary Ledgers

If he draws any money or goods from the business, this will reduce his capital, meaning that an entry should be made on the debit side of his capital account. Any increase in liability is recorded on the credit side of the account, while any decrease is recorded on the debit side. Transactions result in an increase or decrease in the value of various individual balance sheet items. The only difference is that the balance is ascertained after each entry and is written in the debit or credit column of the account. In the standard format of a ledger account, the balance is not stated after each transaction.

Seeing Real-Time Business Insights

Revenue is the business’ income that is derived from the sales of its products and/or services. Revenue can include sales, interest, royalties, or any other fees the business collects from other individuals or businesses. Creating the right structure in your accounting system means that you can track the sales and costs of specific products. You’ll be able to track inventory and suppliers and monitor anything else that can help you make informed decisions. To better understand how a general ledger is used, let’s review the cash general ledger account of Centerfield Sporting Goods.

What is double-entry bookkeeping in the general ledger?

In the case of certain types of accounting errors, it becomes necessary to go back to the general ledger and dig into the detail of each recorded transaction to locate the issue. At times this can involve reviewing dozens of journal entries, but it is imperative to maintain reliably error-free and credible company financial statements. Imagine a vast, organized library where every book represents a financial transaction of a business. This library is the general ledger, the central hub of a company’s financial records. It meticulously catalogs every financial activity, from the smallest expense to the largest revenue, ensuring everything is in its rightful place.

- For example, any outstanding payments against suppliers or any payments to be collected from customers.

- After the journal entry, the debit and credit amounts will be taken to the respective ledger accounts of cash and goods.

- A general ledger represents the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance.

- Having general ledger accounts help you record details of transactions that your business undertakes over an accounting period.

- “As transactions in your business occur, they are noted in the general ledger under each account using double-entry accounting.

The Double Effects of Transactions in Ledger Accounts

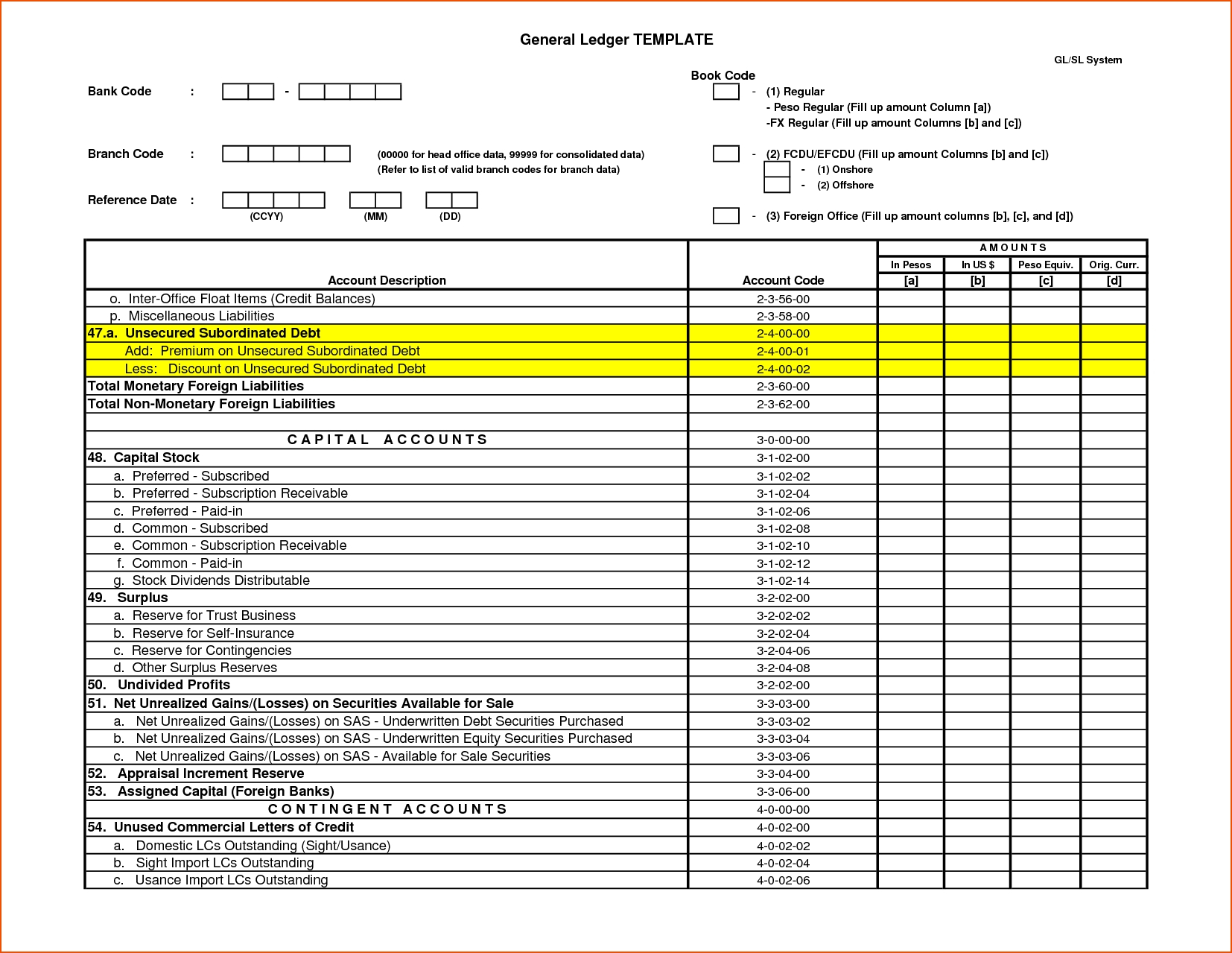

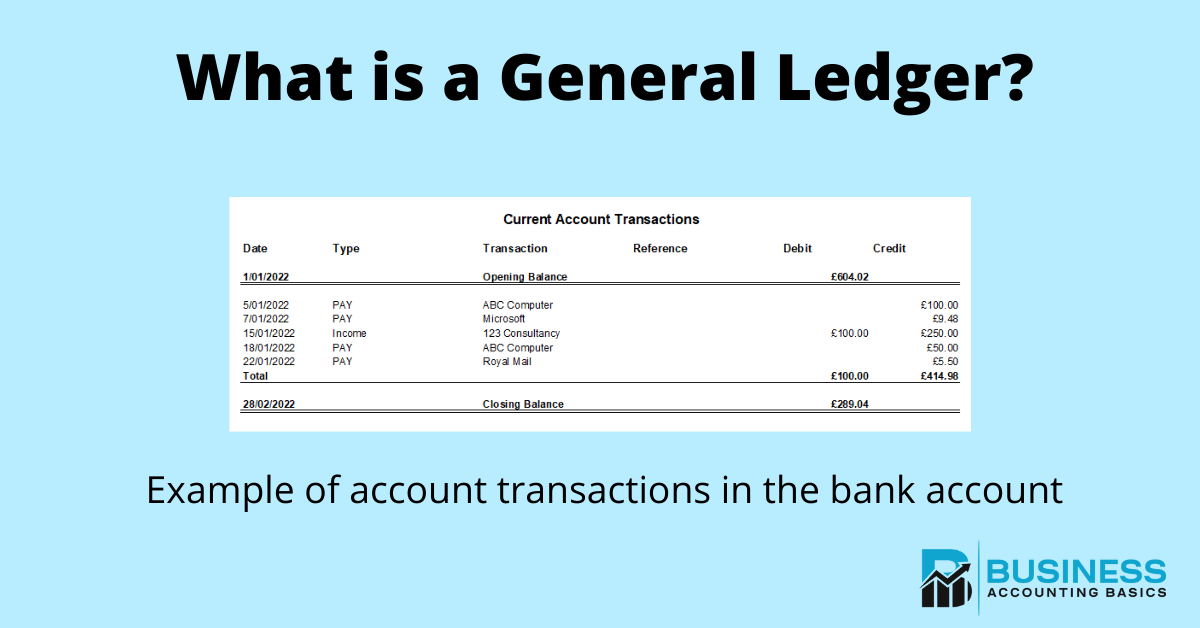

Unlike journal where transactions are recorded in chronological order as they occur, you record transactions in the ledger by classifying them under various account heads to which they relate. Say, for instance, you were overcharged for an item you purchased, it then becomes challenging for you to identify this transaction if the ledger accounts are not prepared. A general ledger helps you to know the ultimate result of all the transactions that take place with regards to specific accounts on a given date. For this reason, general ledger is also known as the Principal Book of Accounting System. Account #1000 is the cash account, and is a partial listing of the general ledger for January 2024. The income statement will also account for other expenses, such as selling, general and administrative expenses, depreciation, interest, and income taxes.

You need to record business transactions in your books of accounts based on the dual aspect of accounting. So, as per the Duality Principle, each transaction will involve a minimum of two accounts, meaning one account will increase while the other decreases. This system of debit and credit helps in finding out the final position of every item at the end of the given accounting period. In each accounting period, entries and account listings are compiled into the essential financial statements of a business, including the balance sheet and income statement.

A general ledger represents the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. It provides a record of each financial transaction that takes place during the life of an operating company and holds account information that is needed to prepare the company’s financial statements. Transaction data is segregated, by type, into accounts for assets, liabilities, owners’ equity, revenues, and expenses. Double-entry absorption costing vs variable costing: what’s the difference transactions, called “journal entries,” are posted in two columns, with debit entries on the left and credit entries on the right, and the total of all debit and credit entries must balance. A general ledger account is a record within the general ledger that tracks all financial transactions related to a specific aspect of a business. These accounts are fundamental components of the double-entry bookkeeping system, ensuring accurate and balanced financial reporting.

“A general ledger (GL) is a parent copy of all the financial transactions of a business. After recording the opening balances (i.e., the amounts at the beginning of an accounting period) in the ledger account, the next step is to record transactions as they take place. General ledgers use the double-entry accounting method, with each transaction in the ledger recorded in two columns, one for debit and another for credit. As mentioned earlier, journal entries represent a good portion of entries in the general ledger. When going over all transactions in the GL and completing your trial balance, you will be able to see all of the accounts’ closing balances and track down any errors, missed payments, or unusual activity. This gives you the chance to reconcile these errors before closing your books at the end of an accounting period.

The general ledger details all financial transactions of all accounts so as to accurately account for and forecast the company’s financial health. Think of the general ledger as the main database of a company’s financial records and information, with other financial documents being derived from the information recorded in the general ledger. A general ledger is the foundation of a system employed by accountants to store and organize financial data used to create the firm’s financial statements. Transactions are posted to individual sub-ledger accounts, as defined by the company’s chart of accounts.

All financial statements like the income statement, balance sheet, and cash flow statement all draw upon the transaction records found in the general ledger. General ledger accounts are the categories that your general ledger is organized by. It’s also called sub-ledgers, which are like the notebooks you use to record your transactions as they occur.